Global Open Banking Partner Directory

Industry expertise at the click of a button

Infocredit

Latest news from Infocredit

eCheck360: The Pan–European PSD2 Open Banking Platform

Infocredit Group, a leading provider of risk management solutions in partnership with Finclude, the pan-European creditworthiness and affordability score provider have joined forces through the eCheck360 Platform allowing for a common European credit score. The eCheck360 Platform provides creditors and lenders with a holistic view of a retail credit applicant. It verifies financial information and assesses the consumer’s creditworthiness and affordability, using machine learning and adaptive learning models. It allows companies to get a comprehensive 360° view of their client’s creditworthiness, affordability, identity and financial behaviour. Also, it allows individuals to assess their current financial health and check whether they can meet their financial obligations.

If your business is offering any type of consumer credit, then become a partner of eCheck360 and contact us at +357 22398000 or email: info@echeck360.com or visit www.echeck360.com

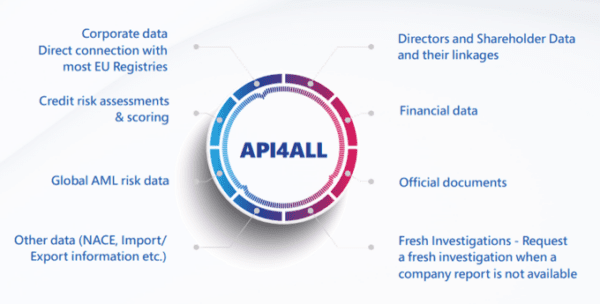

Read more...API4ALL - Access crucial business intelligence

Global Company Information, business intelligence, compliance, and Credit Risk Data – all available through a single API endpoint

Infocredit Group and its subsidiary First Cyprus Credit Bureau (FCCB) offer an API ‘One-for-all’ solution for the first time.

By combining business data received from official sources worldwide, with information on regulatory compliance and the transactional behaviour of entities, Infocredit Group has developed an API which provides users with the ability to receive comprehensive business data with just one 'click'.

Avoid spending valuable time on performing manual credit checks and make accurate business decisions ahead of time.

Read more...Corporate/Business Information Data you can Trust

Proper credit risk management is a key factor for a company's financial prosperity and is one of the most important strategic tools for its viability, growth, and profitability. Credit exposure may have detrimental effects on a company therefore it is essential that a robust approach is adopted to mitigating credit risk and establishing sound credit control policies.

Our tailormade services enhance organization’s credit risk management procedures, preserve business relationships, and secure liquidity. Over the years, we have developed distinct competencies in numerous areas so that our clients can rely on the Business Information Reports they purchase from us or any other credit solution.

Operating on the globe, we are able to provide local/regional intelligence with the most up-to-date and accurate information.

Read more...- Open Banking as a service

- Risk and fraud analytics

- Secure API connection

Contact information

Marketing Team

marketing@infocreditgroup.com+357 22398000