Monzo launches ‘Investments’ product offering BlackRock funds

Ellie Duncan | News

13 Sep 2023

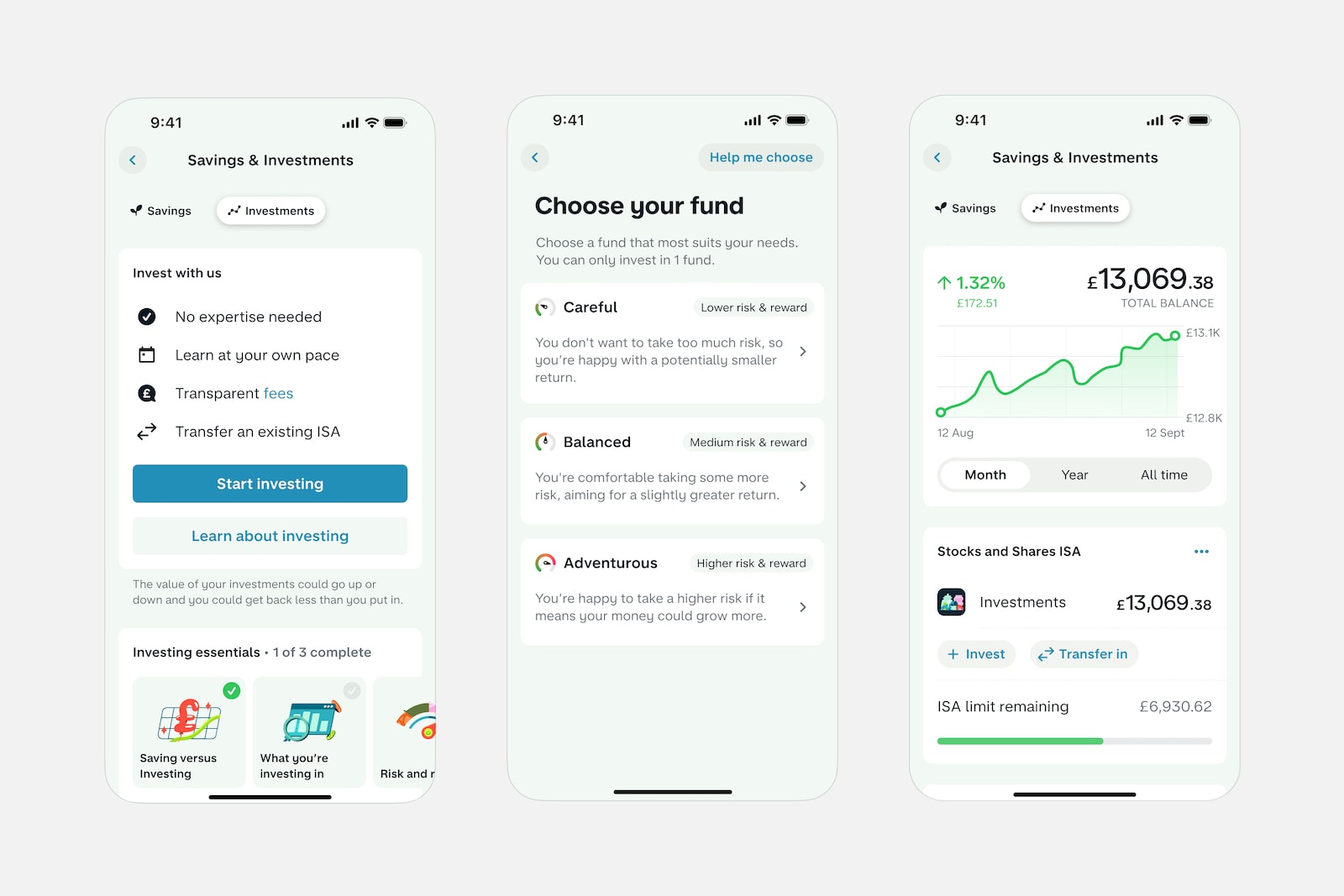

UK-based digital bank Monzo has launched a new product that enables its customers to invest in a range of BlackRock funds with different risk profiles, directly in the app.

Monzo Investments offers three different multi-asset funds managed by BlackRock, named ‘Careful’, ‘Balanced’ and ‘Adventurous’.

Investors are able to change or cancel deposits at any time in the app and withdraw money, when needed, without being charged.

Customers can join a waitlist, with the product set to be rolled out to those who are eligible in the coming weeks.

TS Anil, chief executive officer of Monzo, said the bank’s customers want to invest in longer-term financial goals “but don’t know where to turn or how to get started”.

It has created “jargon-free” guidance for customers throughout the product “journey”

Monzo’s own research revealed that 57% would feel more in control if they could track their spending, saving and investing in one place.

“With Monzo, they now have investment expertise at their fingertips, can invest as little as £1 and track progress alongside their saving, spending and borrowing in the Monzo app.

“This is an important next step on our mission to make money work for everyone as we put the Monzo stamp on another corner of finance that is perceived as complex and inaccessible,” Anil added.

Sarah Melvin, head of UK at BlackRock, said: “We know that for many, taking the first steps into investing can be daunting and it’s often difficult to know where to begin.

“That’s why I’m so proud and excited to bring our global investment expertise to millions of people in the UK through Monzo’s app, giving them the ability to invest in a simple, affordable and accessible way.”

Investors will be a charged a flat fee of 0.59% of the value of their investments, comprising a 0.14% fund fee and a 0.45% platform fee.

For example, with £1,000 invested with Monzo, a customer would pay the equivalent of 48p a month in fees.