Moneyhub and MX form referral partnership

Ellie Duncan | News

10 Jul 2023

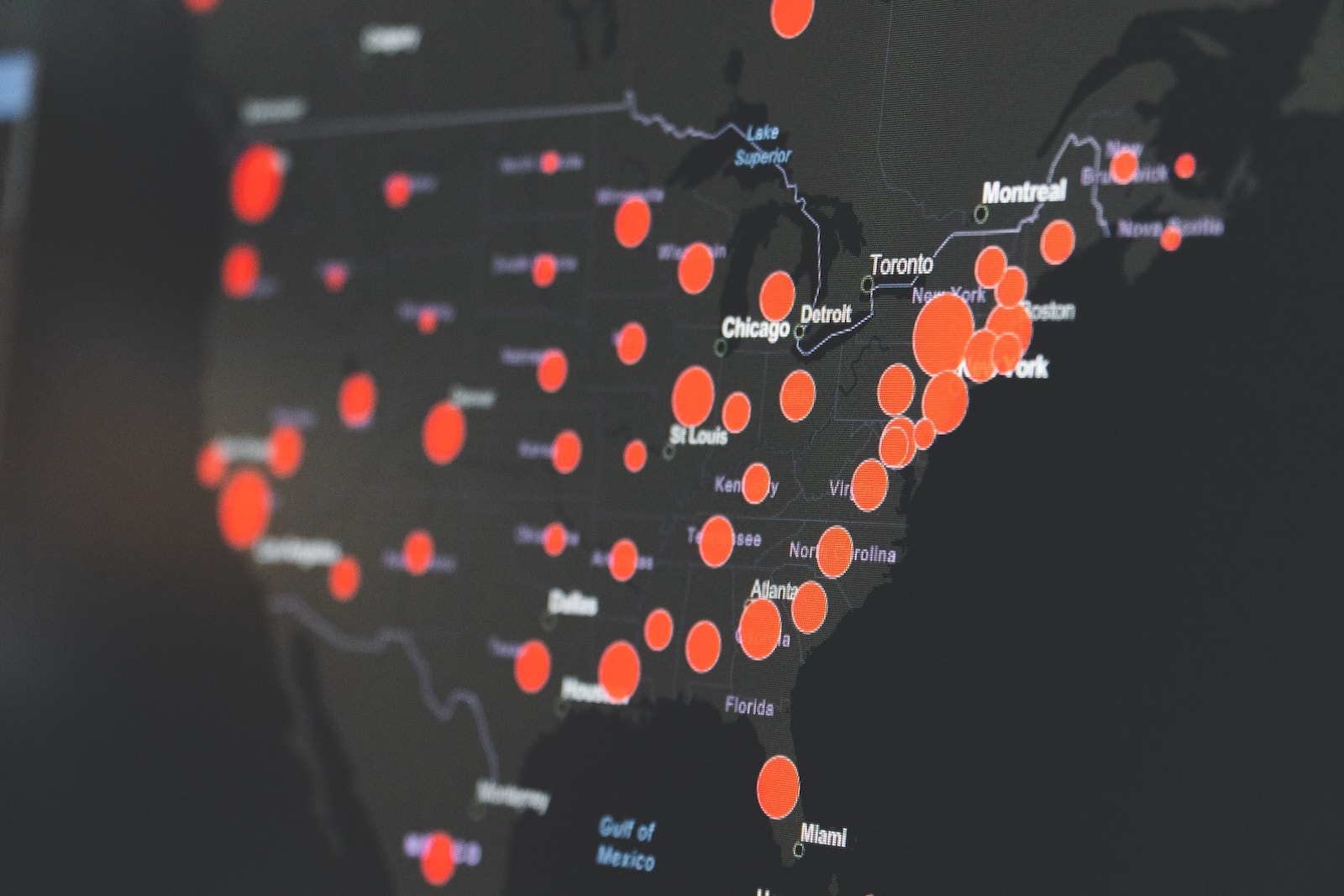

Open data and payments platform Moneyhub has formed a referral partnership with US-based MX Technologies to accelerate the adoption of Open Finance across North America and Europe.

Through the partnership, Moneyhub will be able to refer clients to MX for support in North America, while, in turn, MX can refer clients with a need for Open Finance solutions in European markets, to Moneyhub.

Moneyhub’s PFM platform and Open Banking APIs give consumers and businesses a holistic view of a consumer’s financial situation, using consumer-permissioned data.

MX helps financial institutions, fintechs, businesses, and their consumers in the US and Canada to understand and do more with financial data.

Moneyhub CEO Sam Seaton

Moneyhub chief executive officer Samantha Seaton called the partnership “an exciting development for Moneyhub”.

“It will allow our clients to use consent-driven data to improve their customers’ financial lives, on a global scale. Both businesses are well aligned in terms of not only our products and services, but also our vision and values,” she said.

“We’re thrilled that we can, via this partnership, offer our current and future clients even greater opportunity, and are excited to work alongside MX to create better outcomes for consumers. And with finances stretched, globally, it has never been a more important time to focus on financial wellbeing.”

Raymond den Hond, chief commercial officer, partners at MX added: “MX and Moneyhub share the belief that consumer-permissioned data sharing is critical to the future of our industry and we have an inherent responsibility to improve the money experience for consumers.

“Through this partnership, we’re excited to tap into Moneyhub as an option to meet the needs of our clients who also operate in Europe, enabling them to deliver data-driven, personalised experiences and automated insights to consumers in both regions.”

In June, UK-based savings provider Standard Life announced the rollout of its own Open Finance-powered tool, ‘Money Mindset’, to its existing 1.5 million workplace pension scheme members via a partnership with Moneyhub.

Using the new tool, members will be able to connect their bank accounts, loans, pensions, mortgages, credit cards, ISAs and other financial products in one place.

At Open Banking Expo Canada, on June 15, Andrew Escobar, director, Open Finance at MX moderated the Bank Powerhouse Debate, during which Canada’s largest banks struck an optimistic note about the “current state of play” of Open Banking in the country.