DNA Payments introduces Open Banking for POS terminals

Ellie Duncan | News

17 Jun 2024

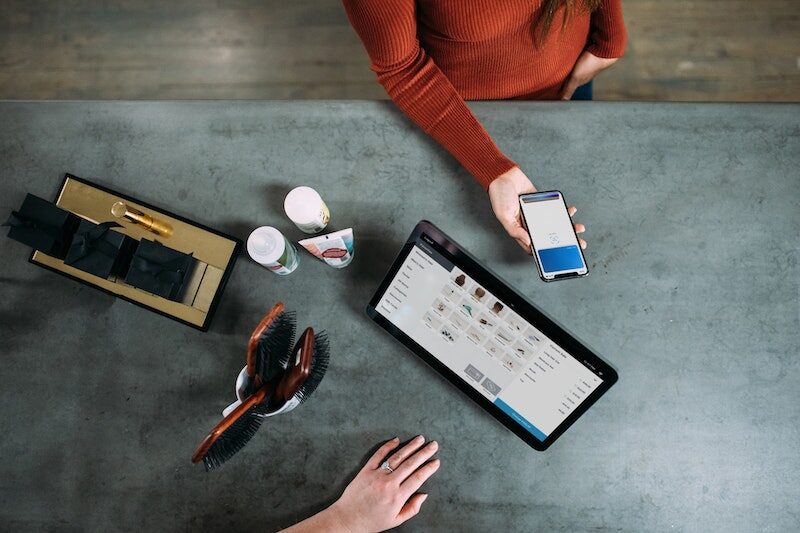

UK-based omnichannel payments provider DNA Payments has launched Open Banking for its ‘axept’ PRO point-of-sale (POS) payment terminals.

By introducing POS Open Banking transactions within DNA Payments’ range of mobile payment methods, customers will be able to pay via their mobile device and banking app.

DNA Payments’ suite of alternative payment methods for payment terminals includes contactless, Apple Pay, Google Pay and Alipay+.

Arif Babayev and Nurlan Zhagiparov, co-founders of DNA Payments, said: “Our commitment to offering merchants flexible, alternative payment options and being at the forefront of the digital economy is strengthened by our launch of Open Banking to our POS terminal estate.

“With Open Banking, anyone with a banking app can make quick mobile payments effortlessly via a QR code on the terminal.”

Babayev and Zhagiparov also cited, among the benefits, fewer chargebacks for its merchants.

Jan-Pieter (JP) Lips, DNA Payments chief executive officer, said that Open Banking payments are particularly cost-efficient for large transactions, such as those made at wholesalers and automotive dealers.

“They don’t attract chargebacks, and because consumers validate their payment in their bank app, they are very secure,” Lips added.

“Our role as DNA Payments is to make this as easy as possible. We enable Open Banking payments by showing a QR code on the payment terminal so the consumer can scan and pay quickly and securely, with settlement and reconciliation easily tracked in our Merchant Portal.”

Lips joined DNA Payments as chief executive officer in January this year, from payments platform Adyen, where he was head of unified commerce.